The economy in 2026 has shown us one thing clearly, the value of cash can be unpredictable. With the rising cost of living and global market shifts, more Malaysians are looking for ways to protect their hard-earned money.

Gold has remained the ultimate safe haven asset for centuries.

If you are looking for a way to secure your financial future, learning how to start saving gold through the Gold Accumulation Program (GAP) is one of the smartest moves you can make.

Understanding the Gold Accumulation Program (GAP)

Many people hesitate to buy gold because they think they need thousands of ringgit to purchase a large bar. The GAP system changes this.

It allows you to accumulate gold weight in a digital account, backed 100% by physical 999.9 (24K) gold stored by Public Gold.

Whether you are a student, a young professional, or a parent saving for your child’s education, the GAP system is designed for everyone.

You can start with as little as RM100, making it one of the most accessible investment options in Malaysia.

The best part? You can withdraw your digital balance into physical gold bars or dinars whenever you choose.

The Secret to Consistency

The biggest challenge most investors face is not the price of gold, but their own discipline. It is easy to say you will save every month, but life often gets in the way. This is where GAP Auto Debit becomes your best financial friend.

By setting up an auto-debit, you automate your wealth building. Every month, a fixed amount (such as RM100, RM200, or RM500) is automatically deducted from your bank account and converted into gold.

This removes the human error of forgetting to save or waiting for a perfect price that may never come.

The Magic of Ringgit Cost Averaging (RCA)

When you use GAP Auto Debit, you are practicing Ringgit Cost Averaging. This is a strategy where you buy a fixed amount of gold regardless of the current market price.

-

When prices are low: Your RM500 buys you more grams of gold.

-

When prices are high: Your RM500 buys you fewer grams.

Over time, this balances out your average purchase price. Instead of trying to time the market which even experts struggle to do, you focus on time in the market.

This strategy is exactly what we recommend for long-term goals, such as the Umrah Gold Saving Challenge, where steady monthly accumulation ensures you have enough gold to fund your pilgrimage without financial stress.

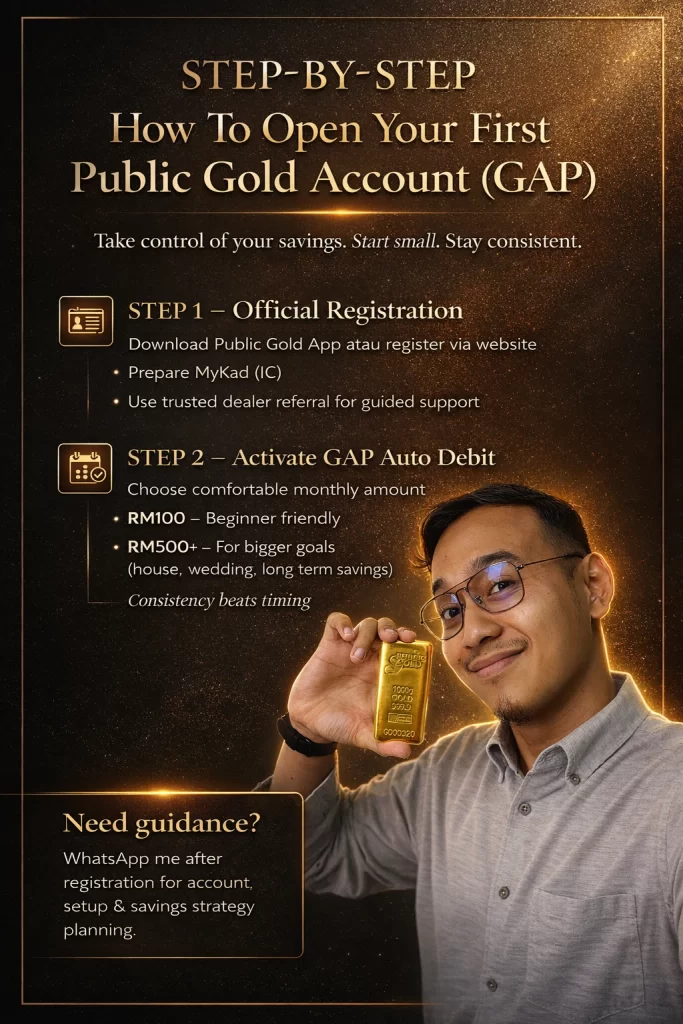

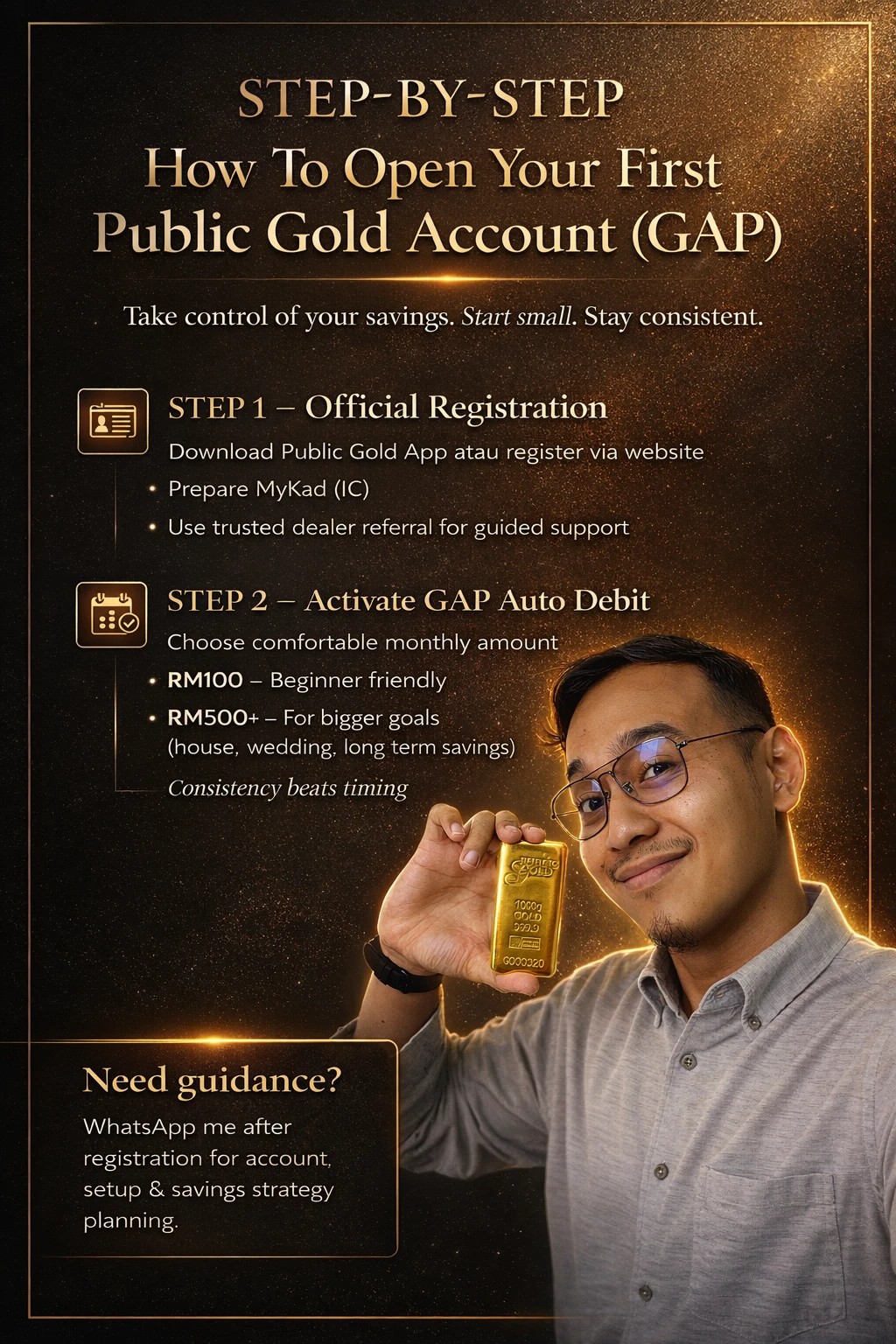

Step-by-Step: How to Open Your First Account

If you are ready to take control of your savings, follow these steps to get started with Public Gold GAP.

1. Official Registration

You can sign up directly through the Public Gold mobile app or official website. You will need to provide your MyKad (IC) details.

Ensure you use a reputable dealer’s referral if you want guided support throughout your journey. Contact me to ensure a smooth registration for your account.

2. Activate GAP Auto Debit

Once your account is verified, navigate to the GAP Auto Debit section. Choose an amount that you are comfortable with, something you won’t miss from your monthly budget.

For many beginners, RM100 is the perfect starting point. For those with bigger goals, like saving for a house or wedding, RM500 or more is ideal.

Need a hand with the setup?

If you need specific guidance on how to manage your account or want to plan your gold savings strategy, please contact me directly via WhatsApp after you have completed your registration.

I’m here to help you make the most of your investment.

3. Set and Forget

The beauty of this system is that it requires zero maintenance. Your gold weight will grow quietly in the background. You can log in once a month just to see your progress and feel the satisfaction of seeing your total grams increase.

Why Public Gold is the Trusted Choice

When you are learning how to start saving gold, security is the most important factor. Public Gold is Shariah-compliant and has a proven track record in Malaysia.

Your gold is stored in a world-class vault, but it remains yours to claim. Whether you want a small 0.5 gram gold card or a 10 dinar coin, the GAP system makes the conversion process seamless.

| Feature | Public Gold GAP |

| Minimum Purchase | RM100 |

| Minimum Withdrawal | 0.5 Gram Physical |

| Shariah Compliance | Certified by Amanie Advisors |

| Storage Fee | RM0 (Free for any amount) |

Common Mistakes to Avoid

Even when you know how to start saving gold, it is easy to fall into these traps:

-

Waiting for the Price to Drop: Many people wait for a dip and end up never buying while the price continues to climb.

-

Treating it Like a Fast Trade: Gold is a long-term wealth protector. Don’t panic if the price drops slightly next week, focus on the weight you own.

-

Not Using Auto-Debit: Manual saving is hard to sustain. Automation is what builds real wealth.

Conclusion

Building a gold reserve is no longer just for the wealthy. With the Gold Accumulation Program and GAP Auto Debit, anyone in Malaysia can become a gold owner.

The best time to start was years ago, but the second best time is today. Don’t wait for the next price hike, start building your weight in grams now and watch your future self thank you for the discipline.

Irfan Said,

Malaysian Gold & Finance Writer.