Physical Gold vs Digital Gold in Malaysia: Which is Better for Long-Term Saving? – Investing in gold can mean owning actual metal bars or coins (physical gold) or buying gold units in electronic form (digital gold) through apps and banks.

In Malaysia, physical-gold companies like Public Gold sell real 999.9 purity bars and dinar coins. Digital options include Bursa Malaysia’s Bursa Gold Dinar (BGD) platform and Gold Investment Accounts (GIA) offered by banks such as Public Bank and Maybank. Each method comes with its own costs, fees, and conditions.

This article compares the value of holding physical gold, focusing on Public Gold bullion, against digital gold accounts. It examines spreads, fees, liquidity, and transparency using current figures.

For long-term savers who value tangible assets, physical gold often stands out for transparency and ownership.

How Physical Gold Works

Physical gold means buying bars or coins and holding them directly. Public Gold offers bars (10g, 20g, 50g, 100g) and 1 Dinar (4.25g) coins at prices tied to international spot rates, quoted in ringgit.

For example, a 10g bar might sell at RM5,410 with a buy-back price of RM4,923. A 1 Dinar coin sells at RM2,299 and is bought back at RM2,092. The difference, or spread, is about 9%.

Public Gold maintains spreads in the 6–9% range under normal conditions. There are no hidden charges, and buy-back rates are among the highest in Malaysia.

Physical gold is tangible. Each piece comes sealed with a certificate of authenticity, providing assurance of purity and weight.

What Are Digital Gold Options?

Digital gold means you own units of gold through an account or app, without receiving bars. In Malaysia, the Bursa Gold Dinar (BGD) app lets users buy fractional grams of 999.9 gold from as little as about RM10. Behind the app, Bursa Malaysia holds real gold bars as backing.

Similarly, banks like Public Bank and Maybank offer gold savings accounts (often called Gold Investment Accounts or GIA) where your account balance is in grams of gold. These digital platforms let you trade gold electronically.

For example, Bursa’s platform quotes a price per gram and lets you buy or sell instantly via your mobile app. However, if you want to take physical delivery (a coin) from BGD, you must pay redemption fees. Likewise, some bank GIAs allow converting your gold holdings into minted coins, but usually with extra charges.

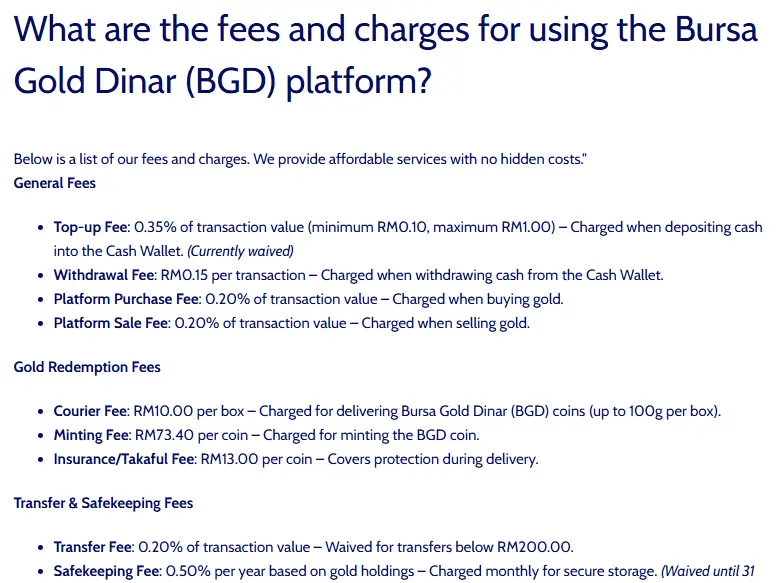

Bursa Gold Dinar is managed by Bursa Malaysia and charges about 0.20% of each transaction when you buy or sell gold. There is also a storage fee of 0.50% per year on your gold holding, though this is currently waived until the end of 2025.

To redeem the gold as physical 1 Dinar (4.25g) coins, Bursa imposes a minting fee of RM73.40 per coin plus about RM13 insurance per coin, and a courier fee of RM10 per box of coins. In short, BGD offers low entry and convenience (digital trading from RM10), but every trade costs a small percentage and converting to cash or coin involves extra fees.

Bank Gold Investment Accounts

Bank Gold Accounts (GIA/MGIA) also work differently. For example, Public Bank’s GIA has a quoted spread of about 3–4%, but it does not allow physical redemption of gold (it stays a digital balance) and charges an annual fee of RM10 if your balance is below 10g at year-end.

As of late August 2025, MIGA-i customers have raised concerns about rising spreads and selling prices. Previously, the spread was around RM9–10 per gram (≈2–3%), but it has since widened to RM13–14 per gram (≈3–4%). In addition, on 25 August 2025, the selling price was adjusted upward by about RM1 per gram despite no change in the international market price.

Maybank does allow physical redemption, but extra charges apply. On top of that, the “Product Disclosure Sheet” and “Terms & Conditions” of MIGA-i state that there is an “agent fee” of up to 0.5% per year on your gold balance in the MIGA-i account if the bank is appointed as an agent to store your gold in a third-party vault.

The MIGA-i account also imposes a service fee of RM5 for certain types of transactions if conducted at a branch over-the-counter; however, online transactions via Maybank2u are usually exempt from this charge.

In summary, bank accounts may have slightly lower spreads on paper, especially Public Bank’s, but they often impose fees or conditions to access or withdraw physical gold.

Costs: Prices, Spreads and Fees Compared

A key difference between physical and digital gold is in how much you pay. Here is a quick comparison of typical costs per RM1,000 of gold (rounded):

Public Gold (Physical)

Spread around 6–9%. A 10g bar might have a buy/sell spread of about 9%. No other fees. The price you see is the total all-inclusive price. They guarantee to buy back your gold at the quoted price and advertise no hidden charges. In practice Public Gold aims to keep spreads within 6–9%, even lower for large bars.

Bursa Gold Dinar (Digital)

Charges 0.20% fee on each buy or sell trade. So buying RM1,000 of gold costs RM2 in platform fees. There is also a 0.50% per year storage fee, though waived through 2025. If you later redeem to coins, you pay about RM73.40 per coin plus RM13 insurance. With 1 Dinar coins (~RM2,300 at present), that’s ~4% extra per coin. In effect, digital gold is more fragmented but fees apply on every step.

Public Bank GIA (Digital)

No physical delivery, just sell for cash or credit. Spread about 3–4%, but if your end-year balance is under 10g, you pay RM10 annual fee. This can be cost-effective for large balances, but small savers pay the fee.

Maybank MIGA-i (Digital)

Spread 3–4% (RM13–14/g as of Aug 2025) | Annual agent fee of up to 0.5% per year | Physical redemption allowed | Spread and selling price recently increased

Jewelry Shops (Physical)

For comparison, retail jewelers typically charge 10–20% premiums over spot to cover craftsmanship. That makes Public Gold’s premiums seem modest by contrast.

In summary, physical gold via Public Gold has a moderate spread of 6–9% but no additional fees. Digital gold accounts often advertise low spreads but add fees that erode returns over time. Over several years these fees can outweigh a slightly lower spread.

| Platform / Option | Spread / Premium | Fees & Charges | Physical Delivery | Notes |

|---|---|---|---|---|

| Public Gold (Physical) | 6–9% spread (lower for large bars) | No other fees, no hidden charges | Yes, bars and dinar coins | Transparent buy-back guarantee |

| Bursa Gold Dinar (Digital) | Spot-based price | 0.20% per trade, 0.50% yearly storage (waived until 2025), ~4% fee for coin redemption | Yes, but with minting + insurance + courier fees | Low entry (from RM10), but fees at every step |

| Public Bank GIA (Digital) | ~3–4% spread | RM10 annual fee if balance <10g, no transaction commission | No physical delivery | Cost-effective only for large balances |

| Maybank GIA (Digital) | ~3-4% spread | Annual agent fee of up to 0.5% per year and other fees (if applicable) | Yes, but with high conversion costs | More expensive long-term |

| Jewelry Shops (Physical) | 10–20% premium | Embedded in jewelry price (craftsmanship) | Yes, jewelry form | Much higher cost vs bullion |

Liquidity and Flexibility

Gold is one of the most liquid assets globally. Whether held as a bar, coin, or digital unit, it can be sold to dealers anywhere. Public Gold emphasizes that precious metals can be easily converted to cash at any time.

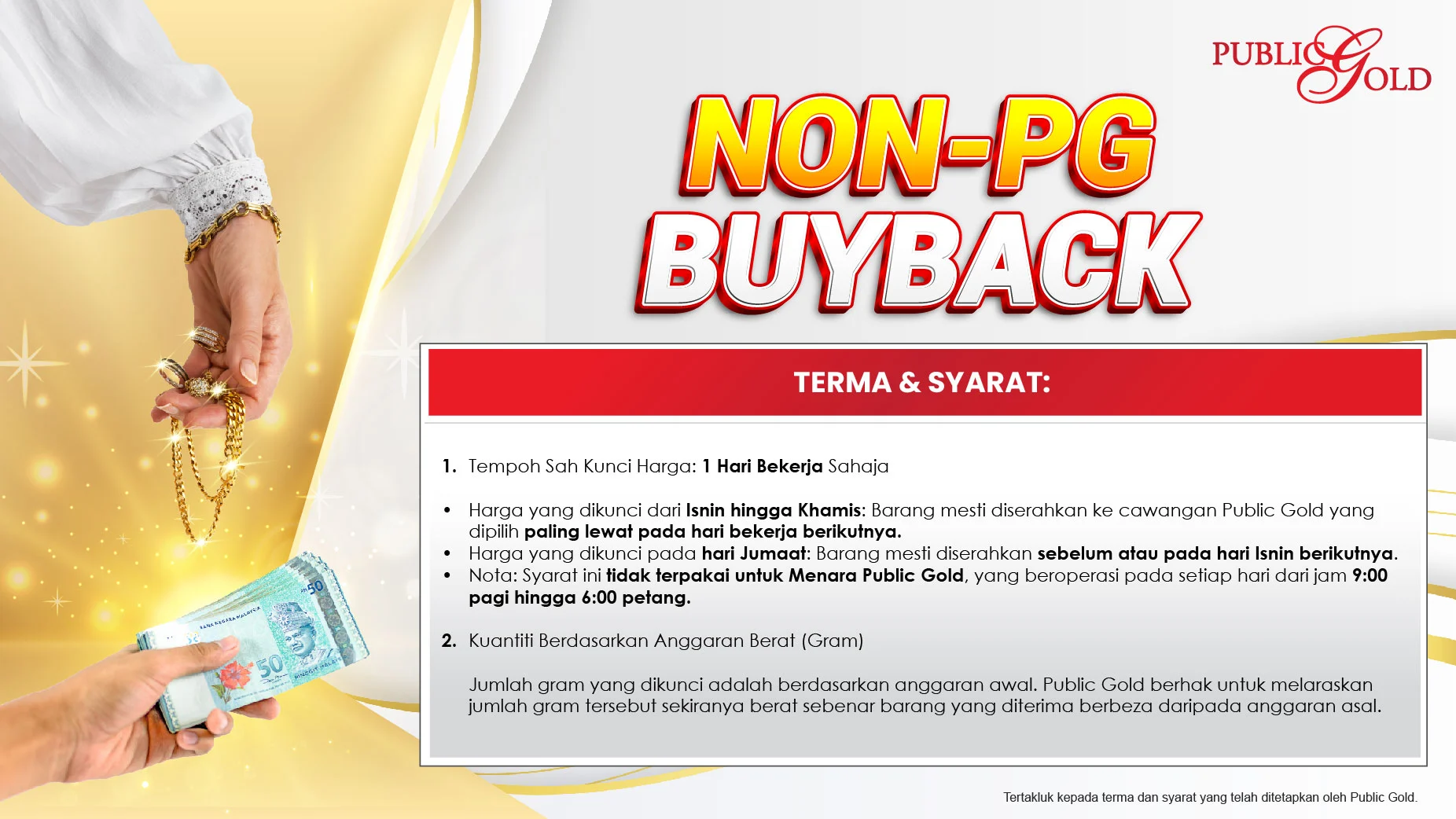

In practice, a Public Gold investor can walk into a branch or send a delivery to have their gold bought back at live rates. Even non-Public-Gold gold can be sold to PG at their non-PG buyback rate.

Physical ownership offers extra flexibility. You can physically store or transport the gold, use it as collateral, or even melt it. It is also portable across borders subject to customs rules. Digital gold depends on a platform or broke, to realize value you often must sell back via that system.

BGD and bank accounts rely on Bursa or the bank to redeem your units. Any restrictions such as minimum withdrawal amounts or account lock-in could delay access. By contrast, Public Gold’s clients actually take delivery of their purchase within around five working days and can store it privately or with a vault service if they choose.

Importantly, gold’s liquidity is nearly universal. Because gold is an international standard you will be able to trade coins and bars in most countries in the world. A Malaysian dinar can be sold to a dealer in Singapore or converted in the UAE.

Digital gold invested in Malaysia similarly has value tied to global prices, but transferring it out requires extra steps. In practice, owning physical gold means you carry no counterparty risk, whereas digital holdings depend on the broker or bank’s continued operation.

Transparency and Trust

Public Gold prides itself on transparent pricing. Its website shows daily gold rates pegged to international markets. Investors see live updates and can easily verify prices against global gold indices. The spread and buy-back policies are published, and each Public Gold bar or coin is stamped 999.9 and comes with a certificate.

Digital platforms like BGD also peg to spot prices, so pricing is transparent. Bursa is a reputable exchange operator, which adds trust. However, the total effective price after fees is less obvious. BGD’s fees are spelled out in their help pages, but a casual investor might miss them.

Bank GIAs publish daily gold rates, but additional charges are hidden in account terms. On security, physical gold avoids bank risk. If a bank or platform has technical issues, your gold investment could become temporarily inaccessible. With physical gold, once purchased, even if the seller went out of business, you still have the metal.

Pros and Cons of Each Method

Physical Gold (e.g. Public Gold)

Pros: Tangible asset under your control; no counterparty; easily verifiable with certificate and weight; highly liquid at global prices; typically lower total cost over time with no recurring fees; suitable for preserving wealth and gifting.

Cons: You bear storage and security; purchase premium over spot; less convenience for tiny trades; you must handle delivery logistics.

Digital Gold (Bursa Gold Dinar)

Pros: Ultra-low entry; easy online buying and selling anytime; backed by real gold reserves.

Cons: Recurring fees on trades and storage; extra cost to convert to physical; reliance on app or broker; more steps to realize full value.

Bank Gold Investment Accounts

Pros: Convenient through your bank; manageable like any account; often Shariah-compliant; allows smaller starting amounts.

Cons: No physical delivery; fees may apply; wider spreads for small trades; funds locked within the bank’s system.

Why Public Gold for Long-Term Saving?

For savers planning to hold gold for years or decades, Public Gold’s physical bullion is often compelling. Its fees are straightforward and limited to the initial spread, also there are no monthly or annual charges. Public Gold’s marketing claims spreads of about 6–9% and no extra charges beyond the price.

In practice, a buyer pays a fixed small premium and knows exactly what that cost is. Over many years of compounding inflation or uncertain markets, not having recurring fees means more of your savings actually stays invested.

Public Gold offers flexibility. You can start small with RM100 through the Gold Accumulation Program and later trade or sell any amount easily. Gold ranks among the most liquid assets, and Public Gold highlights this advantage. You can convert it to cash almost anytime. Their prices also stay competitive compared to retail gold.

Transparency adds another strength. Public Gold publishes daily prices online with no hidden charges. In rare market turmoil, they may adjust spreads, but during normal times, the margin stays stable. If you value control, clear fees, and physical gold in hand, Public Gold makes a strong choice.

Compared to banks or pure digital schemes, Public Gold appeals to those who want physical backup for their wealth with straightforward terms.

Conclusion – Choosing What Fits You

Every gold investment platform has its strengths and weaknesses. Digital options like Bursa Gold Dinar and bank accounts are easy to access. They allow small-scale investing but come with ongoing fees and less direct ownership.

Physical gold, especially through Public Gold, gives you direct and tangible ownership. The pricing is transparent, and there are no recurring fees. This makes it a favorite for long-term savers. Gold is always a stable store of value. But if you prefer holding the metal itself and avoiding hidden costs, Public Gold is a strong choice.

If you want to explore Public Gold’s offerings, a knowledgeable advisor can help. I, Irfan SaidAli, am a Certified Dealer for Public Gold. I guide investors through the process step by step. I can explain the latest prices, help set up an account, and ensure you understand every aspect of physical gold saving.

Public Gold’s team provides solid support, and I will ensure you get personalized attention. Feel free to reach out to me for more information on building long-term wealth with physical gold.

Irfan Said,

Certified Dealer for Public Gold.