Gold has fascinated people for thousands of years, not just for its beauty, but for its ability to hold value when everything else feels uncertain. In today’s fast-changing economy, more and more Malaysians are turning to gold as a way to protect and grow their wealth.

If you’re planning to save or invest in gold, understanding how Public Gold prices work is essential. This guide will walk you through the basics of gold pricing, what drives the price, and how you can start your gold journey with confidence.

What Drives Public Gold Prices Today?

Public Gold prices are influenced by several key factors, including global demand, economic conditions, and investor sentiment. Unlike stocks or bonds, gold doesn’t generate income. Its value is driven purely by supply, demand, and market confidence.

Central bank policies play a big role. When interest rates drop or more money is pumped into the economy, gold becomes more attractive as a safe store of value. On the other hand, higher interest rates may pull investors toward income-generating assets.

Inflation fears also boost gold demand. Gold is often seen as a hedge against rising prices and weakening currency, especially during uncertain times.

And during geopolitical tensions or financial crises, investors tend to turn to gold for stability, driving prices higher.

In Malaysia, Public Gold Marketing Sdn Bhd makes it easier for everyday people to access physical gold, track its price, and invest confidently based on these global market forces.

Best Methods to Monitor Public Gold Market Prices

Monitoring gold price changes requires understanding various pricing mechanisms and data sources. The London Bullion Market Association (LBMA) provides benchmark prices that serve as global reference points for gold trading.

These twice-daily “fixes” help establish the Public Gold price for institutional and retail transactions worldwide.

You can track Public Gold prices in real-time through their official website and mobile app, with prices refreshing every 20 minutes to reflect market movements. In Public Gold’s system:

- PG Sell refers to the price you buy gold from them.

- PG Buy refers to the price you sell gold back to them.

On the website/app, the displayed price is the retail price. When proceeding to checkout, the total amount will include a Gold Premium or an EPP Premium (only applicable if you use the Easy Payment Purchase method).

For serious gold investors, setting up price alerts can be a powerful way to monitor price trends. With Public Gold’s new Price Alert feature, customers can now receive notifications when prices hit their target, making it easier than ever to track gold prices efficiently.

Historical Gold Market Analysis and Patterns

Public Gold started in Malaysia back in 2008, selling basic gold bars like 20g, 50g, 100g, and even 1 kilo. They also introduced gold coins called Dinar, available in 1 Dinar, 5 Dinar, and 10 Dinar sizes.

Back then, the price of gold was only around RM114 per gram. But now in 2025, it’s soared to about RM500 per gram. That’s a whopping 339% increase in just 17 years! Gold has really proven itself as a solid long-term asset.

Since those early days, Public Gold has come a long way. They’ve introduced collectible gold bars featuring famous characters through collaborations with big names like Disney and Marvel.

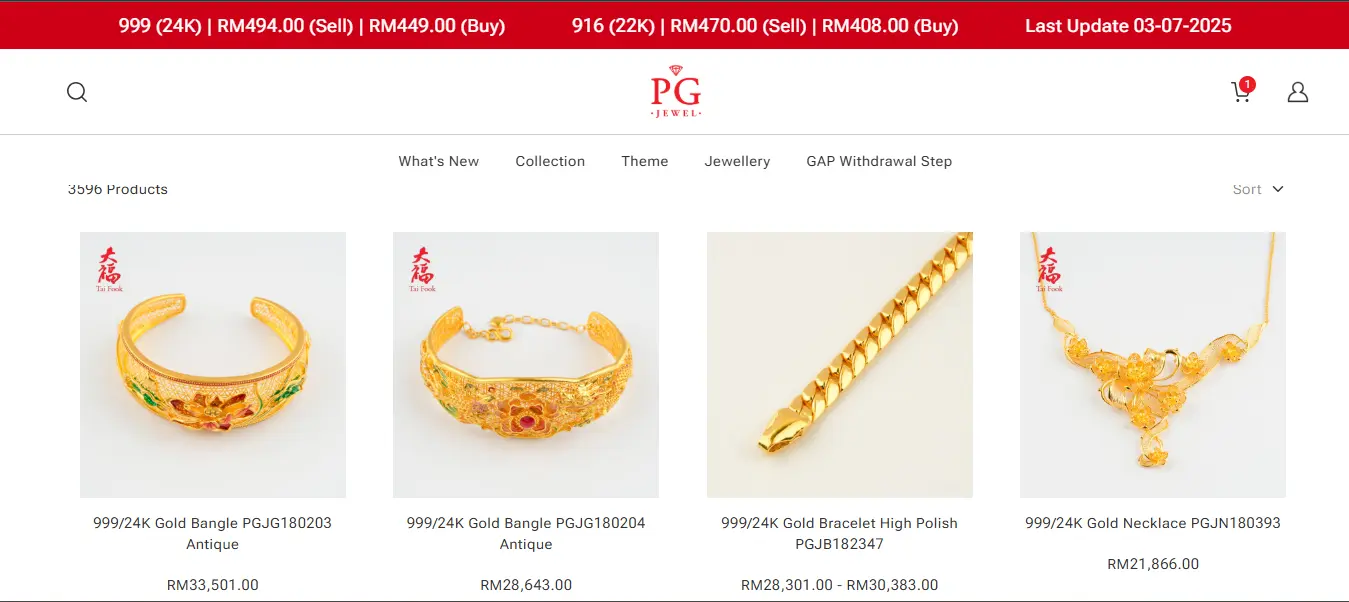

They also launched their own jewellery line called PG Jewel, giving customers more stylish options for gold ownership.

One of their proudest achievements? Installing the first Gold ATM machine in Malaysia, which even got them into the Malaysia Book of Records!

And here’s the latest big news: Public Gold recently acquired 300kg of gold bars all the way from Kyrgyzstan, showing just how serious they are about growing their reserves and operations.

With all these developments, it’s clear that Public Gold isn’t just selling gold. They are actually building an empire around it.

Smart Investment Strategies for Gold Exposure

Developing effective investment strategies around public gold price movements requires understanding your investment objectives, risk tolerance, and time horizon. Different approaches suit various investor profiles and market conditions.

Dollar-cost averaging represents a popular strategy for gold investment. This approach involves making regular purchases regardless of current prices, helping smooth out volatility over time.

It is best to use this strategy in Gold Accumulation Program (GAP) Account to build your asset. This strategy works particularly well for long-term investors who want to build gold positions gradually without trying to time the market.

Other than that, some investors increase their gold allocation during periods of high inflation expectations or geopolitical uncertainty, then reduce holdings when economic conditions stabilize.

Portfolio diversification through gold allocation typically ranges from 5% to 15% of total investment assets. This allocation can help reduce overall portfolio volatility while providing potential upside during periods when traditional assets underperform.

Curious how to save gold? Check out these 3 simple methods!

Macroeconomic Influences on Gold Volatility

Understanding the macroeconomic environment is essential for predicting gold price movements and making informed investment decisions. Several key economic indicators consistently influence gold market dynamics.

Currency strength, particularly the U.S. dollar, inversely correlates with public gold price movements. Since gold is typically priced in dollars globally, dollar strength makes gold more expensive for holders of other currencies, potentially reducing demand and pressuring prices.

Interest rate environments significantly impact public gold price behavior. Rising rates increase the opportunity cost of holding non-yielding assets like gold, while falling rates make gold more attractive relative to bonds and bank deposits.

Economic growth indicators also influence gold price trends. Strong economic growth typically supports risk assets while potentially reducing gold demand, whereas economic weakness often drives safe-haven demand for precious metals.

Final Thoughts: Why Understanding Public Gold Price Matters

Whether you’re a seasoned investor or just starting your gold savings journey, understanding Public Gold price dynamics is key to making smarter financial decisions.

Gold isn’t just about shiny bars and coins, it represents a way to protect your wealth, especially during uncertain times.

From inflation and interest rates to global tensions, many forces shape the price of gold. Learning how these factors work together can give you a clearer view of when and how to invest.

With tools such as real-time price tracking, price alerts, and flexible options like GAP and EPP, Public Gold has made it easier than ever for everyday Malaysians to get involved.

Gold should not be your only investment. However, it is a powerful tool to diversify your portfolio and manage risk more effectively. As always, success is not about perfectly timing the market, but about being consistent, well-informed, and disciplined in your approach.

Public Gold continues to grow impressively. From launching PG Jewel and installing Malaysia’s first Gold ATM, to recently acquiring 300kg of gold from Kyrgyzstan, it is clear that they are building more than a business—they are building a movement.

If you have read this far, you are already one step closer to becoming part of that journey.

Stay informed. Stay consistent. And remember, real wealth grows when we save smartly and plan ahead for the future.