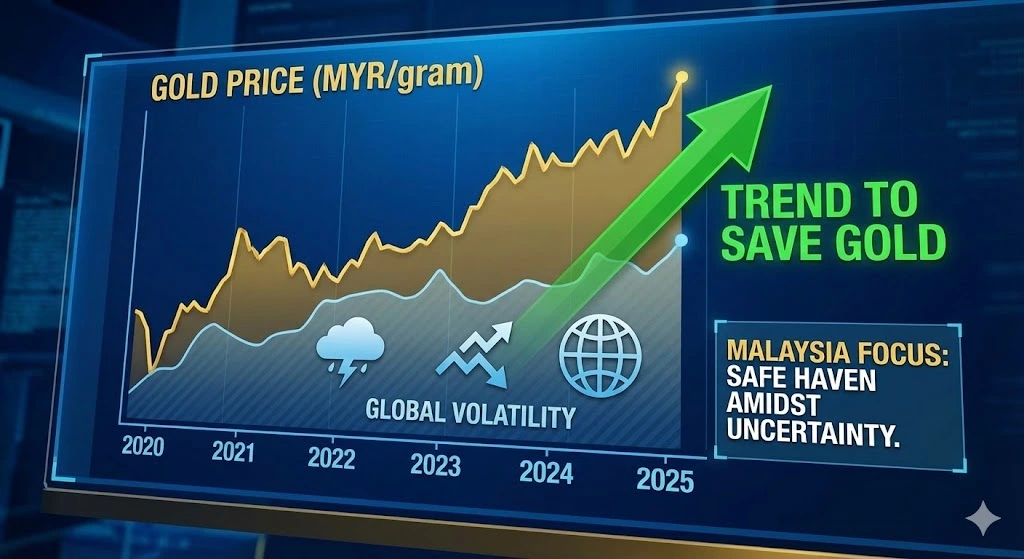

If you have been watching the global markets recently, you know that precious metals are currently trading in a highly volatile environment.

With spot prices fluctuating around the massive $4,100 USD per ounce mark, many locals are asking: Is this the right time to save gold in Malaysia, or should we wait?

Based on recent market data, the answer lies not in timing the market perfectly, but in understanding the fundamental floor prices established by global giants.

Here is an expert analysis of the current market and how Malaysians can utilize reputable platforms like Public Gold to secure their wealth.

The Global Picture: Wall Street vs. Main Street

According to a recent report by Kitco News, there is currently a fascinating tug-of-war happening in the gold market. While gold has struggled to hold gains above $4,100 USD recently, the sentiment remains divided.

Wall Street analysts have become cautious, with only 15% expecting prices to rise in the immediate short term as they await clarity on Federal Reserve interest rates.

However, Main Street (the everyday retail investors) tells a different story. A significant 61% of retail traders remain bullish, expecting prices to climb.

Why does this matter to us? Because despite the volatility, the “floor” price of gold is rising. Central banks purchased a staggering 64 tonnes of gold in September 2025 alone, triple the amount from August.

When the world’s biggest banks are buying, it is a strong signal for individuals to do the same.

Why You Should Save Gold in Malaysia Now

In the Malaysian context, saving gold is about hedging against currency fluctuation and inflation. When the US Dollar strengthens or global geopolitical tension rises, the Ringgit often feels the pressure. Gold acts as your financial shield.

Even though global prices are high, waiting for a massive drop might result in missing the boat entirely. As noted by market strategists, central banks are not selling, they are accumulating.

This creates a strong support level, meaning the downside risk is limited compared to the upside potential.

How to Start with Public Gold Malaysia

For Malaysians, this is where Public Gold Malaysia revolutionizes the industry. Public Gold offers the Gold Accumulation Program (GAP), which allows you to save gold in Malaysia with a low entry point.

Benefits of Public Gold GAP:

-

Affordability: You can start saving with as little as RM100.

-

Security: Your gold is backed by physical gold, 24K (999.9 purity).

-

Shariah Compliant: Endorsed by Shariah advisors, ensuring peace of mind for Muslim investors.

-

Liquidity: You can sell your gold back to Public Gold or withdraw it as physical bars (min 0.5 gram) at any time.

The Verdict: Don’t Wait for “Perfect” Conditions

The market will always be volatile. Analysts will always argue about interest rates and tech bubbles. However, the long-term trajectory of gold as a store of wealth remains intact.

By using a dollar-cost averaging strategy (buying a fixed amount of Ringgit worth of gold every month) through Public Gold, you smooth out the volatility.

You don’t need to worry if the price is $4,100 or $4,050 today. Over time, you build a substantial grammage that protects your future.

Are you ready to build your wealth fortress? Read our previous guide on Getting Started with Gold Investment to learn the step-by-step process of opening your account.

Irfan Said,

Save gold today to save your nation.